Bronx Economy - 2016 Economic & Employment Outlook Bronx NYC

Currently Full Employment, Low Interest Rates, Low Inflation But Possible International Shocks

January 4, 2016 / Bronx Banks & Loans / Bronx Real Estate / Bronx Buzz NYC.

January 4, 2016 / Bronx Banks & Loans / Bronx Real Estate / Bronx Buzz NYC.

We took a look into the crystal ball over the holiday break to see what may lie ahead for the NYC economy in the coming year. We studied the stats and facts put out by many of the national data producers at the Bureau of Labor Statistics, the Federal Reserve, the Treasury Department and the AIE. What follows is a brief summary of some of the statistics we gathered on the global, national and New York City economy including unemployment statistics by borough for 2015.

U.S. & NYC Economy Near / At Full Employment

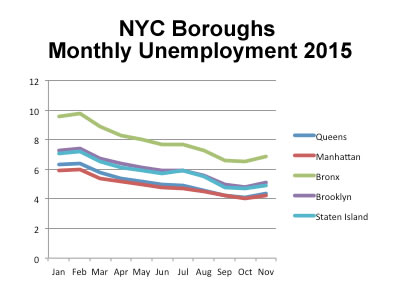

Currently Queens and Manhattan are doing the best with respect to employment, with unemployment rates below 5%, which economists consider to be full employment as the 5% unemployed are viewed as normal 'friction' in the economy, accounting for people coming into, leaving and changing jobs within the labor force.

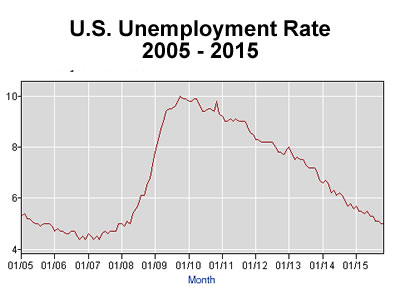

In 2009 - 2010, during the first two years of the Great Recession, the nation's unemployment rate hit 9.4%, while the unemployment rate for New York City hit 10.4%. The employment picture for the nation and the five boroughs of New York City has slowly but steadily improved since then, with unemployment trending lower, reaching full employment this year at 5% for the nation and 4.8% for New York City this fall.

Employment Impact / Relationship to Inflation

Employment affects inflation, as when everyone is fully employed, recruiting firms bid up the price of labor and workers feel secure enough to spend aggressively, bidding up the price of goods. The Federal Reserve attempts to reign in inflation - because it creates economic instability - by raising interest rates which increases the cost of capital needed to expand operations or make large purchases more expensive. On December 16, 2015, the Federal Reserve raised its key short-term interest rate by 25 basis points (0.25%) to begin to get ahead of potentially inflationary issues that may lie ahead. We'll look into a few of these later in this report.

Employment affects inflation, as when everyone is fully employed, recruiting firms bid up the price of labor and workers feel secure enough to spend aggressively, bidding up the price of goods. The Federal Reserve attempts to reign in inflation - because it creates economic instability - by raising interest rates which increases the cost of capital needed to expand operations or make large purchases more expensive. On December 16, 2015, the Federal Reserve raised its key short-term interest rate by 25 basis points (0.25%) to begin to get ahead of potentially inflationary issues that may lie ahead. We'll look into a few of these later in this report.

Economists in one of the banking reports I received believe that there is still slack in the labor market that is not reflected in the numbers as many people have part-time jobs, while they would like full time jobs. Also the labor force participation rate fell during the Great Recession and it became more difficult to find work. Now with a full employment economy it is believed that some of those folks who gave up looking will try to re-enter the workforce. An example of the decline in participation rate might be a spouse who helped supplement household income but couldn't find the right work, and now starts looking again.

Click here to continue reading our report about the Bronx Economy Employment Outlook 2016 NYC which delves into full employment impact on inflation, interest rates, consumer debt levels, oil & commodity prices, domestic and international currencies & economic growth, the financial markets and how all of this may impact the different sectors of the Queens & New York City economy.

Bronx Economy - 2016 Economic & Employment Outlook Bronx NYC

Currently Full Employment, Low Interest Rates, Low Inflation & Possible International Shocks

January 4, 2016 / Bronx Banks & Loans / Bronx Real Estate / Bronx Buzz NYC. Continued.

U.S. & Globlal Interest Rates are Expected to Rise but Still Remain Low

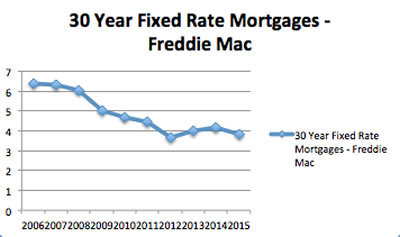

The prime interest rate has been at 3.25% since George W. Bush left the presidency in January of 2009. From September of 2007 to December of 2008 the prime interest rate fell steadily from 8% to 4.0% due to overleveraged financial institutions, many of which had overinvested in real estate. As you can see by looking at the chart to your right, the 30 year fixed interest rates posted by Freddie Mac followed the prime rate downward, trading around the 4% range the past few years.

The prime interest rate has been at 3.25% since George W. Bush left the presidency in January of 2009. From September of 2007 to December of 2008 the prime interest rate fell steadily from 8% to 4.0% due to overleveraged financial institutions, many of which had overinvested in real estate. As you can see by looking at the chart to your right, the 30 year fixed interest rates posted by Freddie Mac followed the prime rate downward, trading around the 4% range the past few years.

The economy has since recovered, posting six years of successive, but slow, Gross Domestic Product [GDP] growth. The slow growth in Gross Domestic Product, which is a measure of the value of the nation's output of products and services, coupled with the slow increase in employment growth, have kept prices relatively stable as the suppliers of goods and service compete for the below standard number of customers spending.

Low Inflationary Trends Have Been Dominated by Oil & Commodities

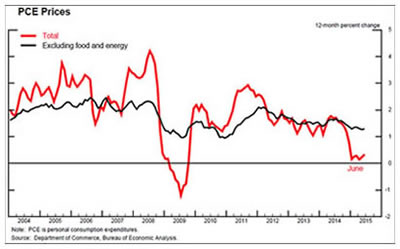

Inflation is a measure of prices in the economy, measuring how much more the same item costs today, than it did a year ago. Inflation had shot upward over 5% during 2008 and then fell into negative territory in 2009 [see PCE Price / Inflation chart at right].

Inflation is a measure of prices in the economy, measuring how much more the same item costs today, than it did a year ago. Inflation had shot upward over 5% during 2008 and then fell into negative territory in 2009 [see PCE Price / Inflation chart at right].

The deflation in 2009 was one of the rare instances in modern times in the American economy that there was actually deflation, when the composite measure of a basked of goods, cost less than it did the year before. The reason for this short lived downturn in inflation was a significant reduction in demand, following in the wake of the Fall 2008 near meltdown of the global financial system.

Since 2009, inflation in the U.S. has been fluctuating between 1% and 4% - until this year when it dropped again due to falling oil and commodity prices. Low inflation is key to low interest rates, as it assures the lender that they will receive their principal back intact [adjusted for inflation], along with a return for having lent the money to the borrower.

Commodities, and in particular oil prices, play a large role in price stability or instability - as the case varies from year to year [see chart above for inflation with and without commodities including food]. Two of the reasons for oil prices falling from a high in 2008 of about $140 per barrel to less than $40 per barrel today are: 1) global economic weakness following the near financial meltdown of 2008 and 2) that U.S. domestic production of oil and natural gas has grown significantly during the Obama years.

The U.S. Develops its Natural Gas & Oil Resources Reducing Reliance on Imported Oil

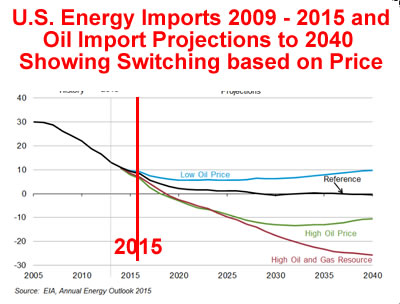

As global economy stalled following the near financial meltdown of 2008, the United States aggressively moved to exploit its domestic energy resources via offshore drilling and natural gas exploration, and thus reduced America's reliance on imported oil for its energy needs [see chart to your right]. The chart at right also includes calculations for the switching to other energy sources in the future, depending on how high oil prices rise.

As global economy stalled following the near financial meltdown of 2008, the United States aggressively moved to exploit its domestic energy resources via offshore drilling and natural gas exploration, and thus reduced America's reliance on imported oil for its energy needs [see chart to your right]. The chart at right also includes calculations for the switching to other energy sources in the future, depending on how high oil prices rise.

Potential Upside. This reduced demand for imported oil caused prices to fall rapidly, given the supply didn't shrink but rather expanded. The falling oil prices have contributed to low inflation, but this situation won't last forever, which is why the Federal Reserve took the precautionary step of beginning to raise interest rates. The falling oil prices also significantly dampened the world economic growth as oil and other commodities represent a sizeable segment of the global economy.

In very general terms this same phenomenon, of declining prices in response to increased supply and slackening demand, has been happening with other commodities around the world. This follows decades long price and supply expansion as many of the developing nations, most notably China, began ramping up their productive capacity and demand.

U.S. & World Economies Impact NYC Economy via Currencies & Trade

A discussion of commodity prices has led us into international waters, where we must address the impact of the global economy on our domestic economy. There is currently a significant amount of unrest in the Middle East where a sizeable portion of the world's oil originates.

A discussion of commodity prices has led us into international waters, where we must address the impact of the global economy on our domestic economy. There is currently a significant amount of unrest in the Middle East where a sizeable portion of the world's oil originates.

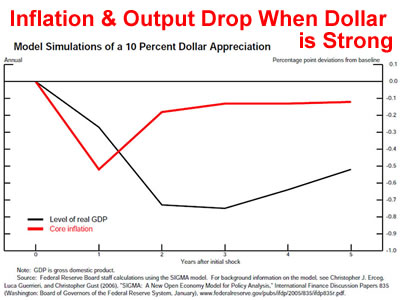

Potential Downside. Should the tensions in that region continue to escalate and military or other forms of unrest manifest themselves by causing a disruption in the supply of oil, the economic forecasts given early in the year could change because increases in the value of the dollar reduce output in the U.S. because foreign goods become cheaper to buy [see chart at right].

We also hear talk that the Middle East nations may need to cash in some of their international investments to make up for the soft prices of oil, which have reduced their national incomes. If true, this disinvestment could put some downward pressure on stocks or other assets, like real estate holdings, in the United States as the foreign governments reduce their investment positions in exchange for cash.

Potential Impact of International Events on NYC Economy - Real Estate

Potential Downside. Locally, this sort of international selling could impact the New York City Real Estate market, resulting in sales of some significant property holdings and / or in withdrawals or reductions in funding of Real Estate Investment Trusts and / or Private Equity companies. Both of these types of investment companies have been aggressively buying buildings in Manhattan, Queens and Brooklyn.

Potential Downside. Locally, this sort of international selling could impact the New York City Real Estate market, resulting in sales of some significant property holdings and / or in withdrawals or reductions in funding of Real Estate Investment Trusts and / or Private Equity companies. Both of these types of investment companies have been aggressively buying buildings in Manhattan, Queens and Brooklyn.

In the most recent quarter some New York City rental prices have softened, but it's important to note that they've softened - not fallen - and from record levels. As anyone can see, there's been a considerable amount of construction in the works in New York City over the past decade, expanding real estate space, which had fallen way behind the growing demand for it. So it's also possible that the housing and commercial building supply is beginning to catch up with demand.

We have seen reports indicating that some of the building boom we've seen throughout the city has begun to slow. In time this could affect construction employment and by association residential spending as construction workers begin tightening their belts and this ripples through the local economy. But at conferences I attended in 2015, pundits who had collected and analyzed current statistics vis a vis historical statistics, informed us that they believed that the market hadn't yet been overbuilt based on historic norms.

Potential Impact of Global Currency Trading on NYC Economy - Financial Services

China is now the world's second largest economy, surpassing Germany and Japan, but still significantly behind the United States. China's manufacturing engine appears to have slowed during 2015 and there are concerns regarding the growth rate of China's continued expansion, as the Chinese recently floated their currency, the Renminbi, on world markets.

China is now the world's second largest economy, surpassing Germany and Japan, but still significantly behind the United States. China's manufacturing engine appears to have slowed during 2015 and there are concerns regarding the growth rate of China's continued expansion, as the Chinese recently floated their currency, the Renminbi, on world markets.

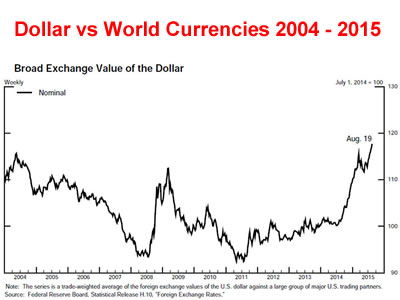

The U.S. dollar has been strong in global currency markets [see chart at right], in part due to unrest in other parts of the world, like the Middle East and Eastern Europe. Issues arose in the Euro Zone this past year, with the Greek debt crisis which included Grecian threats to leave the Euro currency.

In addition there are concerns that the United Kingdom may vacate the European Union - as the current Prime Minister, David Cameron, has promised a referendum on participation in the European Union by the end of 2017. Most U.K. pundits believe that the referendum will be floated long before the end of 2017, and possibly in 2016 with current speculation pegging September 2016 as a possible referendum date. This uncertainty causes traders to vacate the Euro in favor of other, less risky currencies like the American dollar, which is why the dollar has floated upward.

Potential Downside. Also occurring in 2015, the Chinese floated their currency, the Renminbi, on global markets. It was expected that - over time traders would move into the Chinese currency - which in contrast to current Euro woes would draw interest from the dollar. But this hasn't happened as some traders used the floating of the Chinese currency to vacate the Renminbi, believing that the Chinese economy isn't able to compete for trade without continuing the deflationary tactics on its currency that the nation has used to date.

A strong dollar makes American exports expensive [thus reducing demand for them] and makes imports cheaper [thus increasing demand for them as they become more affordable vis a vis other options like domestically produced goods]. The Federal Reserve Bank estimates reductions in GDP growth for each increase in the value of the dollar on global markets as we had previously shown in one of the charts above.

The Chinese Conundrum. Here's the Chinese conundrum: 1) If you continue to devalue your currency, no intelligent investor will invest or lend money into your economy because it will be devalued and 2) If you cease devaluing your currency, buyers of your goods will seek cheaper alternatives.

Potential Impact of Global Growth & Currency Trading on NYC Economy - Investments & Tourism

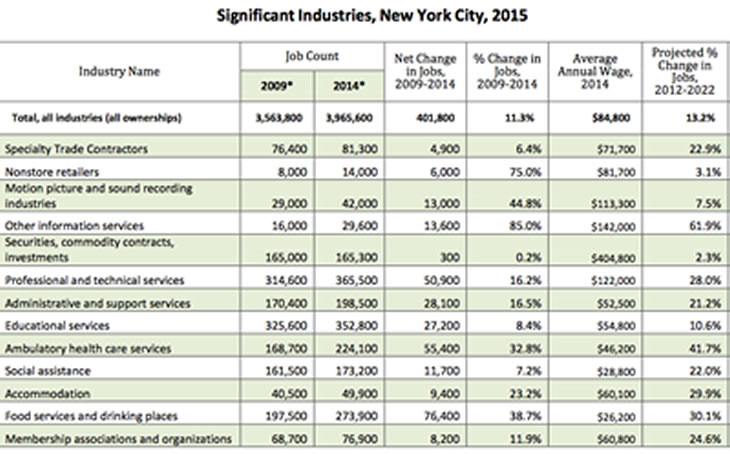

Potential Upside. A strong dollar positively affects New Yorkers in a couple of ways. A strengthening dollar attracts investors to American stocks, as they benefit not just from the stock growth, but also the increases in the value of the American currency vis a vis their own currency. The same is true for real estate investments in New York and the rest of America. Both the stock and real estate markets are significant segments of the New York City economy [see chart below], contributing significantly to the local economy as well as government revenue.

Potential Upside. A strong dollar positively affects New Yorkers in a couple of ways. A strengthening dollar attracts investors to American stocks, as they benefit not just from the stock growth, but also the increases in the value of the American currency vis a vis their own currency. The same is true for real estate investments in New York and the rest of America. Both the stock and real estate markets are significant segments of the New York City economy [see chart below], contributing significantly to the local economy as well as government revenue.

Potential Downside. A strong dollar negatively affects New Yorkers in that it discourages international tourism. New York City receives in the neighborhood of 60 million tourists each year, many of whom travel from other parts of the nation, but also many who travel from distant parts of the world, and who spend significant sums of money on airfare, hotels, restaurants, shops and entertainment venues.

The higher the value of the dollar, the more expensive New York City becomes, making other international travel destinations appear more welcoming. Currency fluctuations are less likely to impact the domestic tourism trade as it don't impact the cost of a New York City vacation. But that said a stronger dollar does make international travel far less expensive, and hence more appealing to those who enjoy traveling abroad. Domestic and European tourists represent the most significant segments of the New York City tourist trade.

New York City Five Boroughs Have Strong Mix of Economic Sectors

Overall we're lucky to be living and working in New York City because we live and work in a very diversified economy that includes financial services, real estate, media / entertainment, tourism [arts, retail, restaurants, hospitality], education, healthcare, professional services and manufacturing.

Overall we're lucky to be living and working in New York City because we live and work in a very diversified economy that includes financial services, real estate, media / entertainment, tourism [arts, retail, restaurants, hospitality], education, healthcare, professional services and manufacturing.

The United States appears to be on far more solid financial footing than it has been in a long while because American households have reduced their debt. But that said, the federal government continues to run significant budget deficits, and the nation still has a very sizeable outstanding debt which it aggressively began running up beginning in the 1980's during the Reagan Administration and has continued running up in all subsequent Administrations save the second term of the Clintons when the deficit became a surplus, and the national debt was actually reduced.

Growing conflict in the Middle East could disrupt oil supplies causing the price of oil to climb and sending shockwaves through the economy. Offsetting that risk is the U.S. currency rising quickly, but that could stymie international exports reducing output. The American stock markets could be negatively impacted by a slowing Chinese economy or by foreign investors' growing need for cash, but uncertainties around the world could also motivate investors to invest in the American stock markets because of the nation's economic and political stability and rising dollar.

The nation is currently running near full employment, commodity prices are expected to stay low [except possibly oil] and while interest rates are expected to climb gradually, they are also expected to continue to stay at low levels. Inflation does not yet appear to be a risk as commodity prices remain low and it is believed the government statistics under report those who would like to be more fully employed.

This report is not intended to forecast what the future will be - meaning whether this will be a strong or soft economic year in the New York economy, but rather to make you - the reader - aware of some of the upsides and downsides associated with changes in international affairs, and the global currency, commodity and stock markets. Ultimately these fluctuations directly and indirectly impact segments of a very diversified, international city economy like ours.

Best wishes for the New Year. It has the potential to be a good one.

Bronx Neighborhood Links

Click on these advertisements for promotions, discounts and special offers by retailers and restaurateurs in NYC.

Bronx NYC Related Links

Click for Bronx Restaurants - Bronx NYC.

Click for Bronx Shopping - Bronx NYC.

Click for Bronx Things To Do NYC - Holidays in Bronx NYC.

Click for Bronx Neighborhoods - Bronx NYC.

Click for Bronx Real Estate & Business - Bronx NYC.

Click for Bronx Schools & Bronx Public Education NYC.

Click for Bronx Street Fairs NYC.

Click for Bronx Politics & Government NYC.

Click for Bronx Farmers Markets NYC.

Click for Bronx Arts & Culture

Site Search Tips. 1) For best results, when typing in more than one word, use quotation marks - eg "Astoria Park". 2) Also try either singular or plural words when searching for a specific item such as "gym" or "gyms".

$element(bwcore,insert_search,N)$

Click the log in link below to create an ID and post an opinion.

Or send this story to a friend by filling in the appropriate box below.